Tomorrow the Government will lay and debate the proposed Corporate Income Tax bill in Parliament. The One Bermuda Alliance will bring an amendment to the bill, to ensure that any windfall from the Corporate Income Tax (CIT) is properly deployed to address Bermuda’s crippling national debt and crumbling infrastructure.

The Premier has spoken often about this proposed tax and the potential benefits to Bermuda. However, he has chosen not to provide to the public, or is unable to provide, any numbers around the actual impact of the bill, whether they be upside, downside, or even the costs to administer the CIT.

The One Bermuda Alliance believes that while there can be benefits to Bermuda from the CIT, there are also many risks. One important risk is that the Government will not handle any possible large revenue from the CIT with the appropriate fiscal responsibility and prudence. Indeed, while the problems of our debt and infrastructure have been well-known for a while, this Government has continued to fail to provide a plan to address them.

Our large debt hamstrings our country in two ways. First, because we have so much debt outstanding ($3.3 billion) (All debt and revenue figures from the 2023/24 Budget Book), we are not able to get materially any more debt to finance key projects and infrastructure. Second, because the debt interest payments are so high ($130.4 million), the money used to pay interest cannot be spent on our island’s pressing needs.

The problems with our infrastructure are well-known to anyone who drives on our roads or has witnessed crumbling retaining walls. These problems are also evidenced by Government’s inability to finish renovating our very own House of Parliament, or properly maintain key national assets like Government House.

The OBA’s amendment will address how CIT funds can be used to reduce our debt and improve our infrastructure. The amendment works as follows. If the CIT revenue exceeds the budgeted amount by a 10% threshold, that revenue is used to pay down our debt to an acceptable level. After that, any excess CIT revenue will be paid into a National Infrastructure Fund, that can be used to fix our roads and other strategic capital infrastructure projects for our island.

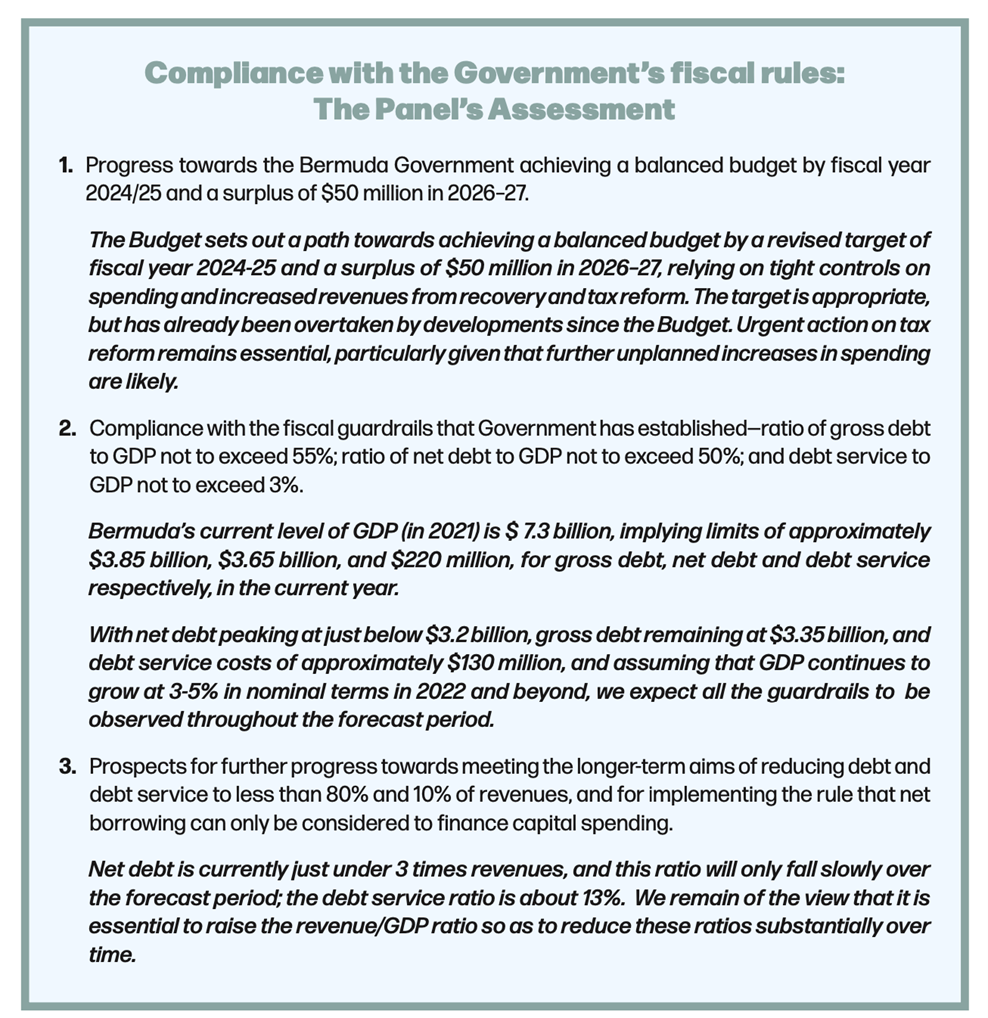

The amendment defines an acceptable level of debt using the Government’s own existing guardrails, specifically being that total debt should be within 80% of revenue, and debt service (interest) costs should be within 10% of revenue, as outlined in the Government’s latest Fiscal Responsibility Panel report.

The One Bermuda Alliance looks forward to bringing this important amendment to Parliament and discussing it during the debate. We are confident that it can be a key part of improving Bermuda’s fiscal position, for the betterment of all Bermudians.